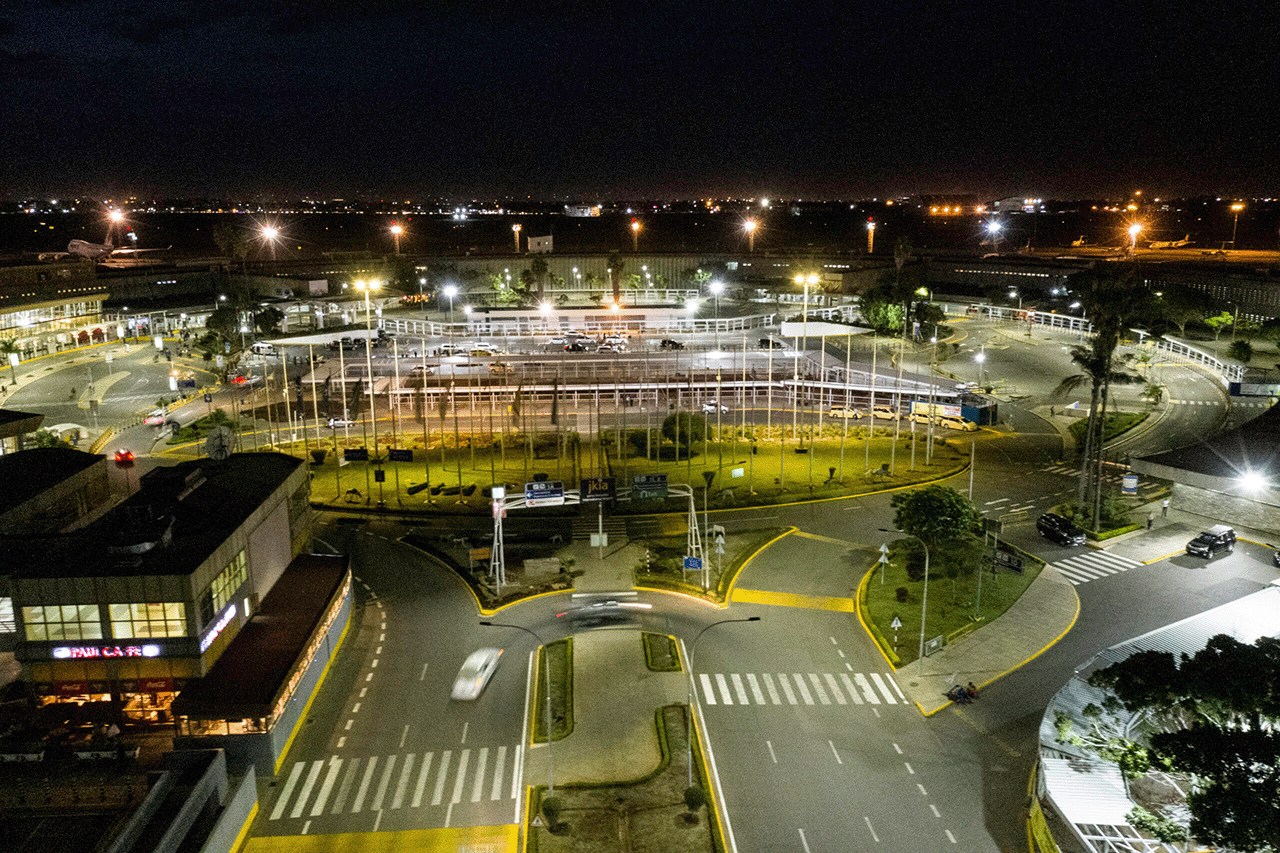

Kenya is embarking on an ambitious plan to expand Jomo Kenyatta International Airport (JKIA), the country’s main aviation hub, at a projected cost of $2 billion. This bold move comes after the government scrapped a controversial deal with India’s Adani Group, choosing instead to oversee the construction directly and possibly lease out operations in the future.

The decision reflects both a shift in financing strategy and a desire for greater national control over key infrastructure. Rather than handing over long-term control to a private entity, the state is now seeking funds from international development partners while retaining ownership and decision-making power during the construction phase.

From Adani to Development Banks

The original agreement with Adani had been touted as a quick route to upgrading JKIA’s facilities, but it was clouded by geopolitical and legal complications. The situation worsened when Adani’s founder was indicted in the U.S., raising ethical concerns and prompting Kenya to walk away from the deal.

Transport Minister Davis Chirchir explained the pivot, saying, “Instead of bringing concessioning to build the airport, we build the airport that we can concession later.” The new plan allows Kenya to ensure the project’s design, execution, and quality align with national priorities before opening it up for private operational management.

To finance the project, Kenya has reached out to major international lenders, including:

-

Japan International Cooperation Agency (JICA)

-

China Exim Bank

-

European Investment Bank (EIB)

-

African Development Bank (AfDB)

-

KfW Development Bank of Germany

These institutions have a history of funding large-scale infrastructure projects in Africa, and securing their support could mean more favorable repayment terms than purely commercial financing.

Scope of the Expansion

The JKIA expansion is designed to position Nairobi as an even stronger aviation hub in East and Central Africa. Key features of the plan include:

-

A second runway to increase capacity and reduce flight delays.

-

A new passenger terminal to accommodate the growing number of travelers, both domestic and international.

-

Upgraded cargo facilities to handle increased freight volumes, boosting Kenya’s role in regional trade.

The improvements are expected to enhance passenger experience, reduce congestion, and attract more international airlines. For Kenya Airways and other regional carriers, the upgrades could be game-changing, allowing them to increase routes and frequencies.

Funding Roads Alongside the Airport

The government is also tying the airport expansion to broader transport improvements. To support JKIA and related infrastructure, Kenya plans to issue a 175 billion shilling ($1.36 billion) securitized bond, backed by revenue from the country’s fuel levy.

The bond will target both domestic and international investors, providing funding for critical road projects that will improve connectivity between the airport and other key economic zones. Efficient ground transport is seen as essential to maximize the benefits of the airport’s upgrades.

Why This Matters for Kenya’s Economy

A modernized JKIA would not just serve passengers—it would have a multiplier effect across multiple sectors:

-

Tourism: Improved facilities could attract more visitors, especially as Kenya continues to market itself as a safari and business travel destination.

-

Trade: Better cargo handling and faster turnaround times would benefit exporters, especially in the agriculture sector where freshness is critical.

-

Investment: A state-of-the-art airport signals to global investors that Kenya is serious about infrastructure and economic growth.

The expansion also aligns with Kenya’s ambition to cement Nairobi’s position as a regional logistics and financial hub.

Balancing Growth and Sovereignty

Kenya’s new approach reflects a broader lesson learned from past infrastructure projects: while public-private partnerships can bring in capital and expertise, they also risk locking the country into long-term agreements that may not favor local interests.

By financing the construction through development banks and government-backed bonds, Kenya retains greater control over timelines, costs, and operational terms. The concession model may still come into play in the future, but only after the asset is fully built and operational.

Challenges Ahead

While the plan is promising, there are hurdles. Negotiating favorable terms with multiple international lenders can be a lengthy process. Ensuring transparency and avoiding cost overruns will be critical, given Kenya’s history of ballooning infrastructure budgets. Additionally, the government will have to manage public debt levels carefully to avoid overburdening taxpayers.

There’s also the challenge of maintaining JKIA’s operations during the construction period. With the airport already handling millions of passengers annually, minimizing disruptions will be essential.

Looking Forward

If successful, the $2 billion JKIA expansion could be one of the most transformative infrastructure projects in Kenya’s recent history. It offers the potential to unlock new economic opportunities, improve Kenya’s connectivity to the world, and position Nairobi as a premier hub in Africa.

As negotiations with development financiers progress, all eyes will be on the terms and timelines the government secures. The ultimate measure of success will be whether the project delivers lasting benefits without compromising Kenya’s economic stability or sovereignty.